Connecting decision makers to a dynamic network of information, people and ideas, Bloomberg quickly and accurately delivers business and financial information, news and insight around the world.

Connecting decision makers to a dynamic network of information, people and ideas, Bloomberg quickly and accurately delivers business and financial information, news and insight around the world. Intelligent Servo Transformer

The Biden administration is still grappling with short supplies of ubiquitous equipment needed to distribute power to where it’s needed, even after the president tapped an emergency wartime law to complement energy incentives in an effort to boost production.

Long lead times for distribution transformers have emerged in recent months as a bottleneck that threatens progress toward meeting climate goals and upgrading the country’s power grid, industry leaders and energy officials said.

The delays persist more than one year after President Joe Biden invoked the Defense Production Act to mobilize federal agency resources to support distribution transformers and other electric grid components.

Officials at the departments of Energy and Labor say they are working to assess ways to expand US production capacity, but warn the problem is rooted in a systemic workforce shortage and supply chain issues that will be difficult to quickly fix. A lack of funding from Congress also limits what the agencies can do.

Electric utilities and manufacturers have been pressing the Biden administration and Congress to do more to support power grid components—and recognize incentives are needed for grid components that are commensurate with those available for solar, wind, and electric vehicles.

“I just think the cart got ahead of the horse,” said Buddy Hasten, president and CEO of the Arkansas Electric Cooperative Corporation who chairs a public-private working group formed in June 2022 to analyze supply chain shortages.

“If we electrify everything, then everything relies on that, we’re going to be putting all of our eggs in the electrical basket,” Hasten added. “And yet we don’t even manufacture the most important devices needed to get that electricity from the East Coast to the Midwest to all over the grid.”

Electric utilities started reporting shortages to the Energy Department about a year and a half ago as the Covid-19 pandemic disrupted supply chains, Bridget Bartol, deputy chief of staff at the Energy Department, said in an interview.

The department heard from the Electricity Subsector Coordinating Council, a group of power sector CEOs that serves as a liaison to the federal government, that wait times for distribution transformers were growing from as short as two months to as long as more than two years.

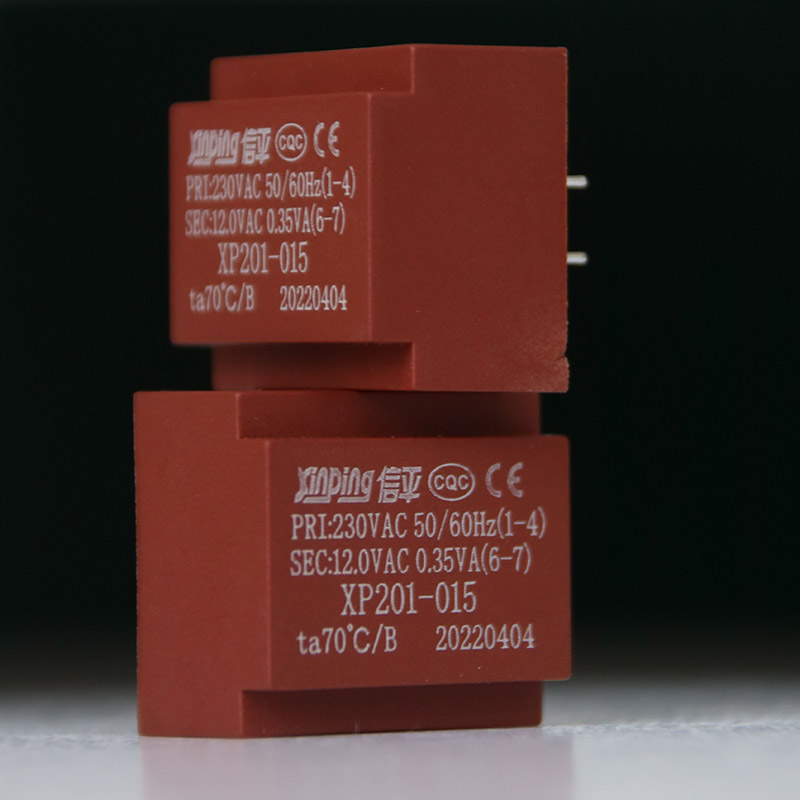

Transformers, which change the voltage of electricity so it can be consumed by homes, businesses, and industrial facilities, are produced by more than a half-dozen US factories. But quickly expanding production faced head winds, the agency found after surveying manufacturers.

For one, volatile commodity markets for copper and aluminum, as well as limited access to specific types of steel made predominantly in Asia, were slowing expansion.

But perhaps the biggest wild card was the availability of skilled labor for factories: Adding more shifts and expanding head count could increase distribution transformer production by as much as 25% or more, manufacturers told the DOE, according to the agency.

“While we thought it was just material dynamics and potential supply and demand imbalance in their supply chain to make a transformer—actually, it was workforce,” Bartol said. “They’re seeing significant workforce and retention problems in their existing manufacturing facilities.”

The rollout of electric vehicles and expansion of the power grid to decarbonize industry—spurred by the 2021 infrastructure bill and climate law of 2022—provides an enormous opportunity to invest in the US, power grid component manufacturers said in interviews.

Capital spending on the distribution grid by investor-owned utilities in 2022 was 20% above the 2020 level, according to the Edison Electric Institute, a trade association of investor-owned electric utilities.

GE Vernova said it’s committed to meeting the growing demand for power from transformer facilities in Wisconsin, North Carolina, and Louisiana, adding 153 jobs with a $28.5 million investment to expand capacity in the latter plant.

“We continue working with the Department of Energy and our customers to ensure our ability to support the broader energy transition, including a further expanded workforce and better availability of raw materials for increased production,” said Andrew Goodman, executive general manager, grid solutions for GE Vernova.

But even bullish multinational companies echoed concerns about finding workers and the level of direct incentives.

“If you build a transformer factory, there isn’t that much really in the different bills in terms of incentive that would really, without a strong market, that would entice you to put a factory in the US,” said Tim Holt, the member of the executive board of Siemens Energy that is responsible for the Grid Technologies business.

Holt gave the example of the company’s Jackson, Miss., factory that makes switchyard gear.

“There’s land next to it, but I wouldn’t find 500 qualified people in the neighborhood,” he said. “At the end, you want to be able to, in a short time, build manufacturing capacity but also be able to churn out a quality product that the customers accept.”

Hitachi Energy, a Swiss company with North American headquarters in Raleigh, N.C., has expanded three of its US plants, two in Virginia and one in Missouri. The company is ramping up conversations with utilities to coordinate product delivery in coming years, said Bruno Melles, managing director of the firm’s transformers business unit.

To find workers “in a situation where the market is accelerating at this speed is something that requires major investment from our side,” Melles said.

Anthony Allard, head of Hitachi Energy in North America, said the infrastructure and climate laws “focused on renewable equipment–solar panels, batteries, et cetera, wind blades—but not necessarily on the infrastructure, the investment in components that you need to build your grid.”

“The US can do more and should look more into additional pieces of legislation to really support the acceleration of investment” in grid components, Allard said.

The utility industry has been working with top administration officials for almost two years on the issue, said Scott Aaronson, EEI’s vice president, security and preparedness.

In June 2022, the Defense Production Act authorized the Energy Department to “rapidly expand American manufacturing” for transformers and grid components and four other categories of clean energy technologies.

“The administration recognizes this is not a theoretical problem,” Aaronson said. “The market has to solve the problem, and maybe it is time to put their thumb on the scale a little bit.”

“We don’t want to get into a baby formula situation where we don’t realize how limited the supply chain is until it’s too late,” Aaronson added, referring to the supply shocks affecting families last year.

But without additional funding, the government’s options aren’t totally clear. Last December, Democratic lawmakers, led by Rep. Sean Casten (D-Ill.), called for $2.1 billion in emergency funding to back up the effort, but it failed to pass.

“Unfortunately, we haven’t received appropriations” for further DPA actions, Bartol said. “We stand ready to work with Congress to share how appropriations could be utilized, and, of course, we’re really working closely with the utilities and manufacturers to understand, from a supply and demand side, what would be beneficial if there were appropriations for that.”

The DOE would not elaborate on the specific funding plans or its communications with Congress.

The Labor Department has encouraged employers to lean on registered apprenticeship programs and make investments in job quality to compete for workers, said Molly Bashay, senior adviser in the agency’s Employment and Training Administration. Labor officials, for about six months, have worked to supply employers with data to identify “pain points” using demographic and workforce data.

“You’re able to get a much finer point on who’s available,” Bashay said. “It’s really about matching the opportunity for individual workers or a community to respond to the opportunities that employers are presenting in these good-quality jobs.”

A spokesperson for Casten said Democrats plan to include transformer funding in an upcoming permitting reform bill this year.

“There’s a real opportunity to address the shortage in electricity transformers this year,” Casten said this week in a statement. “We know this issue will be top of mind at the negotiating table.”

To contact the reporter on this story: Daniel Moore in Washington at dmoore1@bloombergindustry.com

To contact the editor responsible for this story: JoVona Taylor at jtaylor@bloombergindustry.com

AI-powered legal analytics, workflow tools and premium legal & business news.

Core Type Transformer Log in to keep reading or access research tools.